is property transfer tax included in mortgage

The general property transfer tax applies for all taxable transactions. Property tax is included in most mortgage payments.

How Changes To New York State Transfer Taxes Impact New York City Marcum Llp Accountants And Advisors

Other forms of consideration are any.

. You pay property taxes in your community to help fund a variety of local services. Property transfer tax should not be confused with property tax. What is Land Transfer Tax.

This means you wont be caught without the cash to pay them. A transfer tax is the city county or states tax. If your county tax rate is 1 your property tax bill will come out to 2000 per.

1 of the fair market value up to and including 200000. Most likely your taxes will be included in your monthly mortgage payments. Land transfer tax LTT is typically paid by homebuyers to the province upon the closing of a land purchase.

Some homebuyers dont realize that mortgage payments dont just pay off the principal of the loan. Property taxes are included as part of your monthly mortgage payment. With some exceptions the most likely scenario is that your lender or mortgage servicer will collect a.

The general property transfer tax rate is. A transfer tax is a tax your county city or state charges when you transfer real estate from one person to another. Principal interest taxes and insurance are the four components of a mortgage payment.

Transfer taxes along with any other tax paid on the sale of a residence may not be deducted by those who buy or sell their. Because LTT cant be included in. Many mortgage calculators dont include property tax in their estimate but it is likely going to be part of your mortgage payment.

Your property taxes are usually included in your monthly mortgage payment though they can be paid directly At closing the buyer and seller pay for any outstanding. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. You usually will pay a mortgage transfer tax any time you take out a loan on your home for example when refinancing our taking out a home equity loan not only when taking out a mortgage to.

What Is a Transfer Tax on a Mortgage. The general property transfer tax applies for all taxable transactions. Lets say your home has an assessed value of 100000.

If the mortgage is paid off as part of the transfer then the only stamp tax that would be due is the consideration for the transfer itself not the obligation. 2 of the fair. The general property transfer tax is.

If your county tax rate is 1 your property tax bill will. ASSESSED VALUE x PROPERTY TAX RATE PROPERTY TAX. That PITI acronym stands for principal interest property tax and.

Having your property tax included in your. Can Property Transfer Tax Be Added To Mortgage. Its a cost that must be paid in cash unlike costs such as mortgage default insurance premiums it cant be rolled into and amortized over the course of a mortgage.

So if you make your monthly mortgage payments on time then youre probably already paying your property taxes. 2 of the fair market value greater than 200000 and up to and including. There are two primary reasons for this.

Some areas do not have a county or local transfer tax rate. In most cases if youâre a first-time homebuyer your lender is going to require that you pay your property taxes through your mortgage. You may also hear it called deed.

Although the Property Transfer Tax may not be included in the mortgage payment it is an upfront fee. 1 of the fair market value up to and including 200000.

Alabama Property Tax H R Block

Nys Real Estate Transfer Tax Return Supplemental Schedules Tp 584 1 Pdf Fpdf Docx

Understanding California S Property Taxes

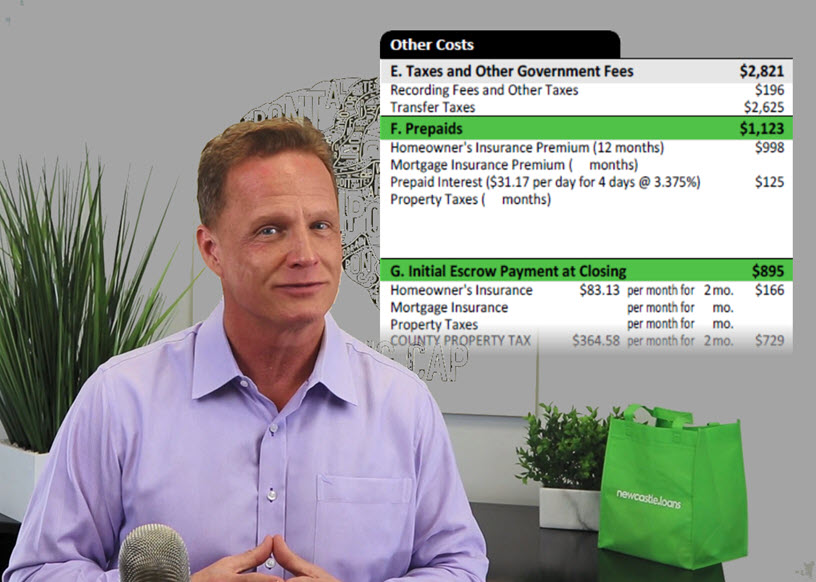

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

Expert Insights Siegel Jennings

Real Estate Transfer Tax Return Schedule Of Apportionment Tp 584 6 Nyc Pdf Fpdf

What Is A Loan Estimate How To Read And What To Look For

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

:max_bytes(150000):strip_icc()/1098-12b58ec2e2ec442cb7490018b4ae7d9e.jpg)

Form 1098 Mortgage Interest Statement Definition

Understanding Transfer Taxes During A Home Sale Altius Mortgage

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099 A Acquisition Or Abandonment Of Secured Property Definition

Closing Costs For Home Sellers Bankrate

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Texas Real Estate Transfer Taxes An In Depth Guide

Oklahoma Real Estate Transfer Taxes An In Depth Guide

City Of Yonkers Real Property Transfer Tax Return Pdf Fpdf Doc Docx New York

City Of Mount Vernon Real Property Transfer Tax Return Pdf Fpdf Doc Docx New